| Avoid LENDHA Loan Company!!! by bizlinks(m): 4:13pm On Jun 23, 2021 |

PLEASE IGNORE THIS POST. ALL ISSUES HAS BEEN SORTED OUT.

Go ahead and work with LENDHA. Thank you |

| Re: Avoid LENDHA Loan Company!!! by Nlanalyst: 4:29pm On Jun 23, 2021 |

No proof? Even a single screenshot to back up your claims?

Am I supposed to just believe your tale because you can write simple and correct English? 3 Likes |

| Re: Avoid LENDHA Loan Company!!! by bizlinks(m): 1:18pm On Jun 24, 2021 |

Nlanalyst:

No proof? Even a single screenshot to back up your claims?

Am I supposed to just believe your tale because you can write simple and correct English? |

| Re: Avoid LENDHA Loan Company!!! by bizlinks(m): 1:21pm On Jun 24, 2021 |

More |

| Re: Avoid LENDHA Loan Company!!! by SavageResponse(m): 2:00pm On Jun 24, 2021 |

bizlinks:

I am writing to report a criminal case in disguise as a financial company called LENDHA.

Lendha claims to be a financial company that gives out loans but in disguise teams up with a payment company called REMITA to siphon people's accounts to the last kobo.

October 2020, Lendha approached us to obtain a business loan from them at 7% monthly interest. The interest is too high for a business loan but after deliberations and promises that the interest will be reduced sooner, we agreed to work with them. We processed a 1.5million naira loan and 2 automatic remittance was activated to our 2 Business accounts (Zenith and Access Bank). On the 30th Nov 2020, we received credit of N1,485,000.

On the 30th December, we paid our first installment by transfer but during our second installment, we noticed that they will request for transfer payment and still debit our account through Remita. This continues and we will always write them for a refund but instead they will hold the fund till our next payment which is a breach of agreement, so we demanded 1% charge daily on every early debit or our funds in their custody as they also placed a 1% default charge on late repayment.

We do not have control over the remita, so we decided to stop transfer payment and allow their Remita to debit our account but they called to inform us that the Remita has been stopped, that we can transfer not knowing that it was a fraud statement. We funded our account and made the transfer for the 4th month repayment. 10mins after the transfer, we started receiving debits to a tone of over 600,000 naira done by the same Remita they claimed to have stopped. We started calling them and writing mails to get our refund but no response. We wrote mail instructing them to end and liquidate the loan in the 5th month by collecting all their outstanding and refunding us our balance but they never reply to our mails or take our calls.

This loan tenor is 6 months, to end 30th May 2021 but we requidated the loan on April 30th 2021 but as we speak now, their Remita is still siphoning every dime in our business accounts thereby making it unsafe for us to use in receiving payments from our customers. So far they have debited us a total sum of N2,522,687.5 against their N2,025,000 total repayment

For you information there is no such thing as interest rate being too high for a business loan afterall some people pay as much at 35% while some pay as little as 4%! Who did you communication your displease concerning the interest rate? Was it in writing? E.g email Did you insist on getting a new loan agreement that has all the new terms written down in it? Which official did you discuss with? This is very key cos if you were talking to a marketing staff then you're on your own; a loan marketing staff will tell you everything you want to hear verbally but if you want something you can take to court then you should be talking to a manager at the minimum or someone who has a strong mandate to enter into binding agreements on behalf of the company...that notwithstanding all agreement must be codified in the agreement you have for it to be legally binding on both parties! You can't come here and claim the company scammed you if they charged you based on what is written in the loan agreement you signed. The onus is on you to prove that they acted in bad faith and to do this successfully you need to provide strong proof that you had another binding agreement which supersedes the one they used |

| Re: Avoid LENDHA Loan Company!!! by bizlinks(m): 3:09pm On Jun 24, 2021 |

Just as your name SavageResponse so does your response. You read and sit to type about the percentage. Did the above writeups point to the loan percentage or the stealing of funds from our accounts! SavageResponse:

For you information there is no such thing as interest rate being too high for a business loan afterall some people pay as much at 35% while some pay as little as 4%!

Who did you communication your displease concerning the interest rate?

Was it in writing? E.g email

Did you insist on getting a new loan agreement that has all the new terms written down in it?

Which official did you discuss with? This is very key cos if you were talking to a marketing staff then you're on your own; a loan marketing staff will tell you everything you want to hear verbally but if you want something you can take to court then you should be talking to a manager at the minimum or someone who has a strong mandate to enter into binding agreements on behalf of the company...that notwithstanding all agreement must be codified in the agreement you have for it to be legally binding on both parties!

You can't come here and claim the company scammed you if they charged you based on what is written in the loan agreement you signed.

The onus is on you to prove that they acted in bad faith and to do this successfully you need to provide strong proof that you had another binding agreement which supersedes the one they used

1 Like |

| Re: Avoid LENDHA Loan Company!!! by sextail(m): 4:32pm On Jun 24, 2021 |

Did you default on your loan? bizlinks:

I am writing to report a criminal case in disguise as a financial company called LENDHA.

Lendha claims to be a financial company that gives out loans but in disguise teams up with a payment company called REMITA to siphon people's accounts to the last kobo.

October 2020, Lendha approached us to obtain a business loan from them at 7% monthly interest. The interest is too high for a business loan but after deliberations and promises that the interest will be reduced sooner, we agreed to work with them. We processed a 1.5million naira loan and 2 automatic remittance was activated to our 2 Business accounts (Zenith and Access Bank). On the 30th Nov 2020, we received credit of N1,485,000.

On the 30th December, we paid our first installment by transfer but during our second installment, we noticed that they will request for transfer payment and still debit our account through Remita. This continues and we will always write them for a refund but instead they will hold the fund till our next payment which is a breach of agreement, so we demanded 1% charge daily on every early debit or our funds in their custody as they also placed a 1% default charge on late repayment.

We do not have control over the remita, so we decided to stop transfer payment and allow their Remita to debit our account but they called to inform us that the Remita has been stopped, that we can transfer not knowing that it was a fraud statement. We funded our account and made the transfer for the 4th month repayment. 10mins after the transfer, we started receiving debits to a tone of over 600,000 naira done by the same Remita they claimed to have stopped. We started calling them and writing mails to get our refund but no response. We wrote mail instructing them to end and liquidate the loan in the 5th month by collecting all their outstanding and refunding us our balance but they never reply to our mails or take our calls.

This loan tenor is 6 months, to end 30th May 2021 but we requidated the loan on April 30th 2021 but as we speak now, their Remita is still siphoning every dime in our business accounts thereby making it unsafe for us to use in receiving payments from our customers. So far they have debited us a total sum of N2,522,687.5 against their N2,025,000 total repayment

|

| Re: Avoid LENDHA Loan Company!!! by bizlinks(m): 11:08am On Jul 03, 2021 |

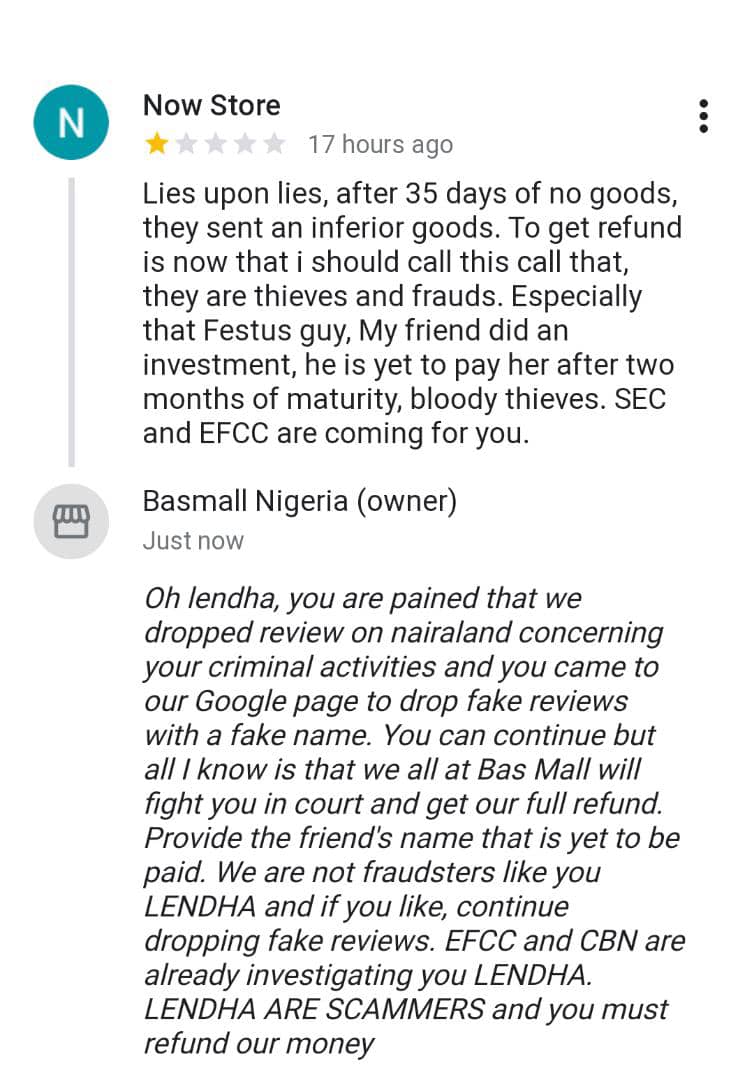

Oh lendha, you are pained that we dropped review on nairaland concerning your criminal activities and you went to our Google page to drop fake reviews with a fake name. You can continue but all I know is that we all at Bas Mall will fight you in court and get our full refund. Provide your friend's name that is yet to be paid his investment interest for 2 month and if you don't provide it here, you must provide it in court! We are not fraudsters like you LENDHA are scammers and if you like, continue dropping fake reviews. EFCC and CBN are already investigating you LENDHA. LENDHA ARE SCAMMERS and you must refund our money

|

| Re: Avoid LENDHA Loan Company!!! by Nobody: 11:16am On Jul 03, 2021 |

pls avoid the loan companies like a plague.

The Bitcoin will undoubtedly be the next global reserve fund. Don't delay to invest and increase your earning in bitcoin.

check n e w g l o b a l r e s e r v e . c o m details |

| Re: Avoid LENDHA Loan Company!!! by bizlinks(m): 4:32pm On Jul 09, 2021 |

PLEASE IGNORE THIS POST. ALL ISSUES HAS BEEN SORTED OUT.

Go ahead and work with LENDHA. Thank you |

| Re: Avoid LENDHA Loan Company!!! by Yesservices(m): 1:38pm On Jul 28, 2021 |

Has been sorted doesn't mean it never happened and happening. There is high probability it will happen again.

Needed a business loan from Lendha but I had to check up for reviews.

I am not comfortable anymore... 2 Likes |

| Re: Avoid LENDHA Loan Company!!! by Gentlevin: 4:16pm On Jul 28, 2021 |

Yesservices:

Has been sorted doesn't mean it never happened and happening. There is high probability it will happen again.

Needed a business loan from Lendha but I had to check up for reviews.

I am not comfortable anymore... Same with me. i had wanted to contact them with some loan for biz but seeing this makes me change my mine. I hate deceit. 1 Like |

| Re: Avoid LENDHA Loan Company!!! by xenastar(f): 8:41pm On Jul 28, 2021 |

Hmm |