| Re: 11 Financial Steps You Should Take Before Age 40 by Raxxye(m): 10:42am On Sep 11, 2021 |

Vipro:

Life is believed to begin at age 40. Before you turn 40, you should have reached some financial milestones in life to make your years as enjoyable as possible.

I share your financial steps you need to take before you turn 40. If you have reached the age of 40, you can still begin to achieve these financial goals, because I think it is never too late to achieve something in life. if you have the commitment and courage.

The list below shows my personal recommendations. You have the choice to make them disappear or not. Still, I think your over-40s would be better if you reached those milestones before you were 40.

1. Pay off debt: Debt can be a major setback in your journey to financial security, especially compound interest debt. You must do everything in your power to pay off all of our debts from those with the highest interest rates.

Your goal should be to lead a debt-free life. Pay off your debt and make sure you don't take it back. You have more peace when you have no debts. Business loans are an exception. However, you should consider other ways to raise capital for your business before considering a business loan.

2. Build marketable skills: If you can do what others can’t do, they’re willing to pay for it. What skills do you have that other people would be willing to pay for? If you don’t have the skills yet, go learn it today. This is very important!

Try to learn a skill that is not common. If everyone can do it, the value will not be high. If you learn or develop a rare skill that you can do almost perfectly and that has a good demand, you can’t go bankrupt because your skills will always give you income.

Some good skills you can learn are graphic design, tablet publishing, hairdressing, catering and decorating, tailoring, vehicle mechanic, generator, computer repair and networking, computer programming, web design, welding and manufacturing, copywriting, nursing , carpentry, tiling, mosaic, application development, POP roof installation, electrical work and many more.

Most of these skills are not taught in colleges and universities, but they can feed you. Therefore, even if you are a graduate, you can learn the skills of someone who has one or in a skill development center. It aims to have at least a good marketable skill before the age of 40.

3. Develop a search for financial education: information is dynamic. New information comes out every day. What you know yesterday may be out of date. Therefore, you should always be alert to new information. You need to make an effort to update your financial knowledge.

Before you turn 40, you need to develop your reading skills. Reading is one of the greatest ways to gain knowledge. You need to learn regularly and quickly. Read good books and research online. For information, you need to learn how to use search engines like Google, Bing, AOL.com, Ask.com, and more.

Get a financial mentor: You need to follow someone who has done what you want them to do to prevent mistakes from being communicated by others and speed up your financial progress.

One way to follow a mentor is to read all of their books or articles.

5. Have an emergency fund -

The need to always have an emergency fund cannot be stressed. An emergency fund is money that goes to your bank account for serious emergencies such as job losses, illness, accidents, disability, and so on. Experts recommend that your monthly living cost be as an emergency fund for at least 6 months.

This money should have good liquidity, but it's best not to keep it in a savings account where you have access to it and for depreciation. You can save the emergency fund to a mutual fund account.

6. Start your own part-time or full-time business - if you’re not starting a business before the age of 40, when will you start it? When do you grow old? Business is a risk and the older you get, the less appetite and risk aversion.

Try starting a business before you turn 40. You can do this part time if you are employed. This will help you learn from your mistakes, grow, and gain experience. Business mistakes and failures get better when you are younger than at age.

7. Get married and have all your children: You have a more balanced view of married life with children. You may not agree with me, but I know that's true.

Married people almost jump into action without thinking. As a married person, think things through various perspectives and think before you move.

Think about the consequences of your actions, as it will affect your family in some way. You think about the couple and also make more balanced decisions, including business decisions, because two good bosses are better than one.

Having your children under the age of 40 also has several benefits, as it helps you grow with your children and helps carry the financial burden of raising your children while you are still young.

8. Build a solid base of passive income streams from paper assets. Paper assets are one of the greatest ways rich people make money almost effortlessly! Warren Buffett is one of the richest men on earth because of his paper assets. Imagine you have invested N50 000 000 in a mutual fund with a low annual interest rate of 10%. This means that it would earn approximately N5,000,000 annually and N 4,16,666 monthly. If you continue to invest interest and capital, you will increase even more in the coming years. Therefore, the rich are getting richer because they use the power compound to use the paper resources.

Before the age of 40, this is the best time to buy a lot of paper assets. Invest in stocks, treasury bills, bonds, mutual funds and other paper assets. He is interested in a wide range of paper

Don't forget to like, share and follow me for more updates. Good article. Where's the source, Op? |

| Re: 11 Financial Steps You Should Take Before Age 40 by obokuntravels: 10:48am On Sep 11, 2021 |

Nice write ups. |

| Re: 11 Financial Steps You Should Take Before Age 40 by otomatic(m): 10:54am On Sep 11, 2021 |

Mokason288:

Very interesting

Remove no 11

Giving to others

Rubbish... how many people have you seen Dangote or Adenuga giving to? Bro, calm down. No remove am yet. Even if na to give to your heirs, na still giving to others. My own be say, never start the giving when you never make am, else if misfortune strikes, all of una both giver and receivers go just de look each other for eye with nobody to help. The order in these things, in my opinion is, earn it, save it, invest it, then spend it and finally start giving it out. That point wey you been invest it go sustain the spending (on yourself) and the giving (to others, heirs included) |

| Re: 11 Financial Steps You Should Take Before Age 40 by pegix(m): 10:57am On Sep 11, 2021 |

By 40 a niggar should be done with producing them 2 kids and outta this country |

| Re: 11 Financial Steps You Should Take Before Age 40 by yusluvad(m): 10:58am On Sep 11, 2021 |

I concur... |

| Re: 11 Financial Steps You Should Take Before Age 40 by Nobody: 11:00am On Sep 11, 2021 |

slawormiir:

Damnnn niggar

Isoright

Motivational speakers...

I hate debt...

Start giving to others.....teach them how to fish

The easiest way to become a Billionaire is to make sure that the people around you are millionaires first

That is why I don't hesitate to give out tools and format to my niggars

Na make the convoy of benz, glk, venza and lexus long na im we dey Being fraudulent, no matter your intentions, or motivations, is one of the surest way to attract a curse on your life and generation. Repent. |

|

| Re: 11 Financial Steps You Should Take Before Age 40 by saintruky(m): 11:09am On Sep 11, 2021 |

slawormiir:

Damnnn niggar

Isoright

Motivational speakers...

I hate debt...

Start giving to others.....teach them how to fish

The easiest way to become a Billionaire is to make sure that the people around you are millionaires first

That is why I don't hesitate to give out tools and format to my niggars

Na make the convoy of benz, glk, venza and lexus long na im we dey Hmmm |

| Re: 11 Financial Steps You Should Take Before Age 40 by Iamnick(m): 11:11am On Sep 11, 2021 |

Vipro:

Life is believed to begin at age 40. Before you turn 40, you should have reached some financial milestones in life to make your years as enjoyable as possible.

I share your financial steps you need to take before you turn 40. If you have reached the age of 40, you can still begin to achieve these financial goals, because I think it is never too late to achieve something in life. if you have the commitment and courage.

The list below shows my personal recommendations. You have the choice to make them disappear or not. Still, I think your over-40s would be better if you reached those milestones before you were 40.

1. Pay off debt: Debt can be a major setback in your journey to financial security, especially compound interest debt. You must do everything in your power to pay off all of our debts from those with the highest interest rates.

Your goal should be to lead a debt-free life. Pay off your debt and make sure you don't take it back. You have more peace when you have no debts. Business loans are an exception. However, you should consider other ways to raise capital for your business before considering a business loan.

2. Build marketable skills: If you can do what others can’t do, they’re willing to pay for it. What skills do you have that other people would be willing to pay for? If you don’t have the skills yet, go learn it today. This is very important!

Try to learn a skill that is not common. If everyone can do it, the value will not be high. If you learn or develop a rare skill that you can do almost perfectly and that has a good demand, you can’t go bankrupt because your skills will always give you income.

Some good skills you can learn are graphic design, tablet publishing, hairdressing, catering and decorating, tailoring, vehicle mechanic, generator, computer repair and networking, computer programming, web design, welding and manufacturing, copywriting, nursing , carpentry, tiling, mosaic, application development, POP roof installation, electrical work and many more.

Most of these skills are not taught in colleges and universities, but they can feed you. Therefore, even if you are a graduate, you can learn the skills of someone who has one or in a skill development center. It aims to have at least a good marketable skill before the age of 40.

3. Develop a search for financial education: information is dynamic. New information comes out every day. What you know yesterday may be out of date. Therefore, you should always be alert to new information. You need to make an effort to update your financial knowledge.

Before you turn 40, you need to develop your reading skills. Reading is one of the greatest ways to gain knowledge. You need to learn regularly and quickly. Read good books and research online. For information, you need to learn how to use search engines like Google, Bing, AOL.com, Ask.com, and more.

Get a financial mentor: You need to follow someone who has done what you want them to do to prevent mistakes from being communicated by others and speed up your financial progress.

One way to follow a mentor is to read all of their books or articles.

5. Have an emergency fund -

The need to always have an emergency fund cannot be stressed. An emergency fund is money that goes to your bank account for serious emergencies such as job losses, illness, accidents, disability, and so on. Experts recommend that your monthly living cost be as an emergency fund for at least 6 months.

This money should have good liquidity, but it's best not to keep it in a savings account where you have access to it and for depreciation. You can save the emergency fund to a mutual fund account.

6. Start your own part-time or full-time business - if you’re not starting a business before the age of 40, when will you start it? When do you grow old? Business is a risk and the older you get, the less appetite and risk aversion.

Try starting a business before you turn 40. You can do this part time if you are employed. This will help you learn from your mistakes, grow, and gain experience. Business mistakes and failures get better when you are younger than at age.

7. Get married and have all your children: You have a more balanced view of married life with children. You may not agree with me, but I know that's true.

Married people almost jump into action without thinking. As a married person, think things through various perspectives and think before you move.

Think about the consequences of your actions, as it will affect your family in some way. You think about the couple and also make more balanced decisions, including business decisions, because two good bosses are better than one.

Having your children under the age of 40 also has several benefits, as it helps you grow with your children and helps carry the financial burden of raising your children while you are still young.

8. Build a solid base of passive income streams from paper assets. Paper assets are one of the greatest ways rich people make money almost effortlessly! Warren Buffett is one of the richest men on earth because of his paper assets. Imagine you have invested N50 000 000 in a mutual fund with a low annual interest rate of 10%. This means that it would earn approximately N5,000,000 annually and N 4,16,666 monthly. If you continue to invest interest and capital, you will increase even more in the coming years. Therefore, the rich are getting richer because they use the power compound to use the paper resources.

Before the age of 40, this is the best time to buy a lot of paper assets. Invest in stocks, treasury bills, bonds, mutual funds and other paper assets. He is interested in a wide range of paper resources.

9. Investing in real estate: Investing in real estate is one of the best investments you can ever make because it is always appreciated in value over time. In addition to food, rental housing costs are one of the biggest expenses for the family.

Before you turn 40, it would be good to build your house. See here how you can build your low-income home. In the worst case, even if you haven’t built a house, try to buy land before you’re 40 years old.

10. You have your own farm: Have you thought about how people without farmers would survive? You can say, ‘I don’t have to be a farmer, because I can always buy the food I need’. Let me ask you: What if you have money to buy food and there is no food to buy because there are no farmers?

Even if you don’t want to grow full time, try a backyard garden where they plant vegetables. This will help you appreciate the wonderful work that farmers do.

Investing in agriculture can also be a good way to build wealth. There is always a market available for agricultural products. I have written several articles on agro-industry and how you can benefit from it.

11. Start giving to others: You can get as much wealth and wealth as you can, but if you can’t find a way to help others, you won’t know what the accomplishment is. The true measure of life does not lie in how much you have, but in how much you give.

Start allocating a portion of your monthly income to help others, especially the needy, children, and the elderly. You can take responsibility for sponsoring a disadvantaged child through school. You can adopt a child. You can meet the needs of disadvantaged children and the elderly on a monthly basis.

I can really do this without the stress of writing articles and maintaining this blog as I don’t get a reasonable financial benefit from it. My joy, though, is that this blog is helping thousands of people overcome poverty and remain financially stable.

Start handing out people now. You don’t have to be very rich to help others. Give what little you have because it opens more doors of resources. There are many people around you who need your help and help. You can deliver cash or to babies in need, disabled and motherless at home. You can sponsor a poor child through school. There are inexhaustible ways to give to others.

Bonus Tips:

1. Write a will. Many financial experts recommend getting a lawyer to help you make a will that legally grants ownership of your properties to everyone you want when you go ahead. This is especially important in conflicting families.

2. Buy an insurance policy: Several financial experts also advise you to buy life insurance. The goal is to give your loved ones a financial advantage if you go further.

There you have it. It is not good for anyone to collect information unless it is used. The choice is yours.

For more suggestions, leave a comment in the section below.

Don't forget to like, share and follow me for more updates. Nice piece |

| Re: 11 Financial Steps You Should Take Before Age 40 by Dmeji4444(m): 11:14am On Sep 11, 2021 |

|

| Re: 11 Financial Steps You Should Take Before Age 40 by Diamond1993: 11:16am On Sep 11, 2021 |

slawormiir:

Damnnn niggar

Isoright

Motivational speakers...

I hate debt...

Start giving to others.....teach them how to fish

The easiest way to become a Billionaire is to make sure that the people around you are millionaires first

I dey your back bro

That is why I don't hesitate to give out tools and format to my niggars

Na make the convoy of benz, glk, venza and lexus long na im we dey |

| Re: 11 Financial Steps You Should Take Before Age 40 by Herbephe1(m): 11:21am On Sep 11, 2021 |

As l de live my life I don't know either I'm going forward or backward, things are really getting complicated |

|

| Re: 11 Financial Steps You Should Take Before Age 40 by Pelicanmedia: 11:32am On Sep 11, 2021 |

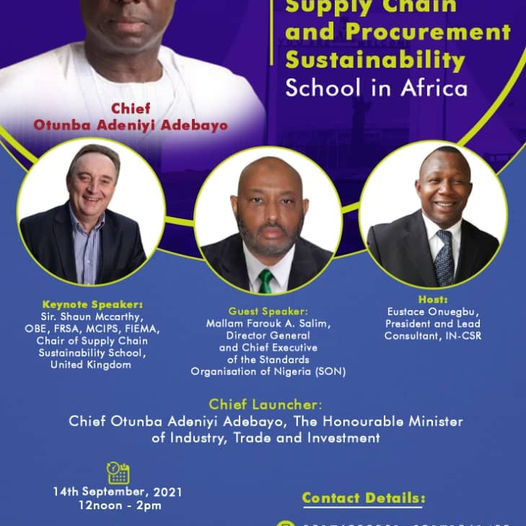

CERTIFICATE OF PARTICIPATION TO BE ISSUED BY PECB CANADA Dear Colleagues, CERTIFICATE OF PARTICIPATION TO BE ISSUED BY PECB CANADA AN INVITATION TO THE LAUNCH OF ISO 20400 SUSTAINABLE SUPPLY CHAIN AND PROCUREMENT SCHOOL IN AFRICA You are strongly advised to register with a valid email address to enable our partners, the Professional Evaluation and Certification Board (PECB), Canada issue you with a certificate of participation.This hybrid (physical and virtual) launch is billed for the 14th of September 2021 from 12 noon to 2 pm. The physical event will be held at the Minister’s Conference Hall, the Federal Ministry of Industry, Trade and Investment, Old Federal Secretariat, Garki 1, Abuja while virtual participation can be accessed via this registration link: https:///2Wlxd03.All participants will receive participation certificates* .We are looking forward to welcoming you at this important pan African event. Best regards!*Eustace Onuegbu* CMSA, FASPN, FIMC, CMC President, IN-CSR Head, Supply Chain Sustainability School, Africa PECB Accredited Partner REGISTER HERE: https://us06web.zoom.us/meeting/register/tZwoceuorjwuEtbiuKhqUqJog1eWF66f5QHx

|

| Re: 11 Financial Steps You Should Take Before Age 40 by Nobody: 11:39am On Sep 11, 2021 |

slawormiir:

Damnnn niggar

Isoright

Motivational speakers...

I hate debt...

Start giving to others.....teach them how to fish

The easiest way to become a Billionaire is to make sure that the people around you are millionaires first

That is why I don't hesitate to give out tools and format to my niggars

Na make the convoy of benz, glk, venza and lexus long na im we dey Real niggar thumbs up |

| Re: 11 Financial Steps You Should Take Before Age 40 by razzydoo(m): 11:42am On Sep 11, 2021 |

30 is the new 40. |

| Re: 11 Financial Steps You Should Take Before Age 40 by Hezzyluv: 11:48am On Sep 11, 2021 |

The5DME:

I don't care about all what you wrote there. All I care about is that no parent should bring a child, into poverty in this country. Being poor in Nigeria is akin to being in hell. I know what I'm passing through everyday. I feel your pain man, Same here. Just praying to God for my Visa to workout before the end of this month. "Make man go hustle money come back establish himself" 1 Like |

| Re: 11 Financial Steps You Should Take Before Age 40 by toprealman: 11:49am On Sep 11, 2021 |

Mr100Dollars:

30 is the most annoying age... How many times have you been there? |

| Re: 11 Financial Steps You Should Take Before Age 40 by HuncleDee: 12:06pm On Sep 11, 2021 |

So nursing is now a skill,and anybody can learn |

| Re: 11 Financial Steps You Should Take Before Age 40 by Crossroad1(m): 12:14pm On Sep 11, 2021 |

Mr100Dollars:

30 is the most annoying age... 30-36, most confusing age |

| Re: 11 Financial Steps You Should Take Before Age 40 by yusuf99(m): 12:18pm On Sep 11, 2021 |

Very nice � Vipro:

Life is believed to begin at age 40. Before you turn 40, you should have reached some financial milestones in life to make your years as enjoyable as possible.

I share your financial steps you need to take before you turn 40. If you have reached the age of 40, you can still begin to achieve these financial goals, because I think it is never too late to achieve something in life. if you have the commitment and courage.

The list below shows my personal recommendations. You have the choice to make them disappear or not. Still, I think your over-40s would be better if you reached those milestones before you were 40.

1. Pay off debt: Debt can be a major setback in your journey to financial security, especially compound interest debt. You must do everything in your power to pay off all of our debts from those with the highest interest rates.

Your goal should be to lead a debt-free life. Pay off your debt and make sure you don't take it back. You have more peace when you have no debts. Business loans are an exception. However, you should consider other ways to raise capital for your business before considering a business loan.

2. Build marketable skills: If you can do what others can’t do, they’re willing to pay for it. What skills do you have that other people would be willing to pay for? If you don’t have the skills yet, go learn it today. This is very important!

Try to learn a skill that is not common. If everyone can do it, the value will not be high. If you learn or develop a rare skill that you can do almost perfectly and that has a good demand, you can’t go bankrupt because your skills will always give you income.

Some good skills you can learn are graphic design, tablet publishing, hairdressing, catering and decorating, tailoring, vehicle mechanic, generator, computer repair and networking, computer programming, web design, welding and manufacturing, copywriting, nursing , carpentry, tiling, mosaic, application development, POP roof installation, electrical work and many more.

Most of these skills are not taught in colleges and universities, but they can feed you. Therefore, even if you are a graduate, you can learn the skills of someone who has one or in a skill development center. It aims to have at least a good marketable skill before the age of 40.

3. Develop a search for financial education: information is dynamic. New information comes out every day. What you know yesterday may be out of date. Therefore, you should always be alert to new information. You need to make an effort to update your financial knowledge.

Before you turn 40, you need to develop your reading skills. Reading is one of the greatest ways to gain knowledge. You need to learn regularly and quickly. Read good books and research online. For information, you need to learn how to use search engines like Google, Bing, AOL.com, Ask.com, and more.

Get a financial mentor: You need to follow someone who has done what you want them to do to prevent mistakes from being communicated by others and speed up your financial progress.

One way to follow a mentor is to read all of their books or articles.

5. Have an emergency fund -

The need to always have an emergency fund cannot be stressed. An emergency fund is money that goes to your bank account for serious emergencies such as job losses, illness, accidents, disability, and so on. Experts recommend that your monthly living cost be as an emergency fund for at least 6 months.

This money should have good liquidity, but it's best not to keep it in a savings account where you have access to it and for depreciation. You can save the emergency fund to a mutual fund account.

6. Start your own part-time or full-time business - if you’re not starting a business before the age of 40, when will you start it? When do you grow old? Business is a risk and the older you get, the less appetite and risk aversion.

Try starting a business before you turn 40. You can do this part time if you are employed. This will help you learn from your mistakes, grow, and gain experience. Business mistakes and failures get better when you are younger than at age.

7. Get married and have all your children: You have a more balanced view of married life with children. You may not agree with me, but I know that's true.

Married people almost jump into action without thinking. As a married person, think things through various perspectives and think before you move.

Think about the consequences of your actions, as it will affect your family in some way. You think about the couple and also make more balanced decisions, including business decisions, because two good bosses are better than one.

Having your children under the age of 40 also has several benefits, as it helps you grow with your children and helps carry the financial burden of raising your children while you are still young.

8. Build a solid base of passive income streams from paper assets. Paper assets are one of the greatest ways rich people make money almost effortlessly! Warren Buffett is one of the richest men on earth because of his paper assets. Imagine you have invested N50 000 000 in a mutual fund with a low annual interest rate of 10%. This means that it would earn approximately N5,000,000 annually and N 4,16,666 monthly. If you continue to invest interest and capital, you will increase even more in the coming years. Therefore, the rich are getting richer because they use the power compound to use the paper resources.

Before the age of 40, this is the best time to buy a lot of paper assets. Invest in stocks, treasury bills, bonds, mutual funds and other paper assets. He is interested in a wide range of paper resources.

9. Investing in real estate: Investing in real estate is one of the best investments you can ever make because it is always appreciated in value over time. In addition to food, rental housing costs are one of the biggest expenses for the family.

Before you turn 40, it would be good to build your house. See here how you can build your low-income home. In the worst case, even if you haven’t built a house, try to buy land before you’re 40 years old.

10. You have your own farm: Have you thought about how people without farmers would survive? You can say, ‘I don’t have to be a farmer, because I can always buy the food I need’. Let me ask you: What if you have money to buy food and there is no food to buy because there are no farmers?

Even if you don’t want to grow full time, try a backyard garden where they plant vegetables. This will help you appreciate the wonderful work that farmers do.

Investing in agriculture can also be a good way to build wealth. There is always a market available for agricultural products. I have written several articles on agro-industry and how you can benefit from it.

11. Start giving to others: You can get as much wealth and wealth as you can, but if you can’t find a way to help others, you won’t know what the accomplishment is. The true measure of life does not lie in how much you have, but in how much you give.

Start allocating a portion of your monthly income to help others, especially the needy, children, and the elderly. You can take responsibility for sponsoring a disadvantaged child through school. You can adopt a child. You can meet the needs of disadvantaged children and the elderly on a monthly basis.

I can really do this without the stress of writing articles and maintaining this blog as I don’t get a reasonable financial benefit from it. My joy, though, is that this blog is helping thousands of people overcome poverty and remain financially stable.

Start handing out people now. You don’t have to be very rich to help others. Give what little you have because it opens more doors of resources. There are many people around you who need your help and help. You can deliver cash or to babies in need, disabled and motherless at home. You can sponsor a poor child through school. There are inexhaustible ways to give to others.

Bonus Tips:

1. Write a will. Many financial experts recommend getting a lawyer to help you make a will that legally grants ownership of your properties to everyone you want when you go ahead. This is especially important in conflicting families.

2. Buy an insurance policy: Several financial experts also advise you to buy life insurance. The goal is to give your loved ones a financial advantage if you go further.

There you have it. It is not good for anyone to collect information unless it is used. The choice is yours.

For more suggestions, leave a comment in the section below.

Don't forget to like, share and follow me for more updates. |

| Re: 11 Financial Steps You Should Take Before Age 40 by Emmy000seun(m): 12:24pm On Sep 11, 2021 |

Bro make I roll with you now.. slawormiir:

Damnnn niggar

Isoright

Motivational speakers...

I hate debt...

Start giving to others.....teach them how to fish

The easiest way to become a Billionaire is to make sure that the people around you are millionaires first

That is why I don't hesitate to give out tools and format to my niggars

Na make the convoy of benz, glk, venza and lexus long na im we dey |

| Re: 11 Financial Steps You Should Take Before Age 40 by merits(m): 12:36pm On Sep 11, 2021 |

|

| Re: 11 Financial Steps You Should Take Before Age 40 by ImmaculateJOE(m): 1:02pm On Sep 11, 2021 |

Master piece. |

| Re: 11 Financial Steps You Should Take Before Age 40 by Rolly22(m): 1:20pm On Sep 11, 2021 |

kb83:

Nice right up! Though laudable, However Time and unforseen circumstances can change everything as planned. May the Almighty Guide us right. The major obstacle of life. |

| Re: 11 Financial Steps You Should Take Before Age 40 by mohlanforex: 1:30pm On Sep 11, 2021 |

40 is too high

it's better to get this skills by early 30. 1 Like |

| Re: 11 Financial Steps You Should Take Before Age 40 by Mymehn: 1:30pm On Sep 11, 2021 |

Bro wetin dey shele |

| Re: 11 Financial Steps You Should Take Before Age 40 by UrVillagePpl: 1:51pm On Sep 11, 2021 |

Quite interesting...

Thanks OP for this post

We shall get there |

| Re: 11 Financial Steps You Should Take Before Age 40 by damoceile: 2:18pm On Sep 11, 2021 |

This is achievable only if you're from a well to do family or you live in a sane clime. |

| Re: 11 Financial Steps You Should Take Before Age 40 by Divoc19(f): 2:33pm On Sep 11, 2021 |

My goodness. You are funny  m140:

.Just like in boxing you always got a plan until you get hit in the face...

May God almighty make things work as we want... life dey somehow ooo |

| Re: 11 Financial Steps You Should Take Before Age 40 by BluntCrazeMan: 2:37pm On Sep 11, 2021 |

Vipro:

Life is believed to begin at age 40. Before you turn 40, you should have reached some financial milestones in life to make your years as enjoyable as possible.

I share your financial steps you need to take before you turn 40. If you have reached the age of 40, you can still begin to achieve these financial goals, because I think it is never too late to achieve something in life. if you have the commitment and courage.

The list below shows my personal recommendations. You have the choice to make them disappear or not. Still, I think your over-40s would be better if you reached those milestones before you were 40.

1. Pay off debt: Debt can be a major setback in your journey to financial security, especially compound interest debt. You must do everything in your power to pay off all of our debts from those with the highest interest rates.

Your goal should be to lead a debt-free life. Pay off your debt and make sure you don't take it back. You have more peace when you have no debts. Business loans are an exception. However, you should consider other ways to raise capital for your business before considering a business loan.

2. Build marketable skills: If you can do what others can’t do, they’re willing to pay for it. What skills do you have that other people would be willing to pay for? If you don’t have the skills yet, go learn it today. This is very important!

Try to learn a skill that is not common. If everyone can do it, the value will not be high. If you learn or develop a rare skill that you can do almost perfectly and that has a good demand, you can’t go bankrupt because your skills will always give you income.

Some good skills you can learn are graphic design, tablet publishing, hairdressing, catering and decorating, tailoring, vehicle mechanic, generator, computer repair and networking, computer programming, web design, welding and manufacturing, copywriting, nursing , carpentry, tiling, mosaic, application development, POP roof installation, electrical work and many more.

Most of these skills are not taught in colleges and universities, but they can feed you. Therefore, even if you are a graduate, you can learn the skills of someone who has one or in a skill development center. It aims to have at least a good marketable skill before the age of 40.

3. Develop a search for financial education: information is dynamic. New information comes out every day. What you know yesterday may be out of date. Therefore, you should always be alert to new information. You need to make an effort to update your financial knowledge.

Before you turn 40, you need to develop your reading skills. Reading is one of the greatest ways to gain knowledge. You need to learn regularly and quickly. Read good books and research online. For information, you need to learn how to use search engines like Google, Bing, AOL.com, Ask.com, and more.

Get a financial mentor: You need to follow someone who has done what you want them to do to prevent mistakes from being communicated by others and speed up your financial progress.

One way to follow a mentor is to read all of their books or articles.

5. Have an emergency fund -

The need to always have an emergency fund cannot be stressed. An emergency fund is money that goes to your bank account for serious emergencies such as job losses, illness, accidents, disability, and so on. Experts recommend that your monthly living cost be as an emergency fund for at least 6 months.

This money should have good liquidity, but it's best not to keep it in a savings account where you have access to it and for depreciation. You can save the emergency fund to a mutual fund account.

6. Start your own part-time or full-time business - if you’re not starting a business before the age of 40, when will you start it? When do you grow old? Business is a risk and the older you get, the less appetite and risk aversion.

Try starting a business before you turn 40. You can do this part time if you are employed. This will help you learn from your mistakes, grow, and gain experience. Business mistakes and failures get better when you are younger than at age.

7. Get married and have all your children: You have a more balanced view of married life with children. You may not agree with me, but I know that's true.

Married people almost jump into action without thinking. As a married person, think things through various perspectives and think before you move.

Think about the consequences of your actions, as it will affect your family in some way. You think about the couple and also make more balanced decisions, including business decisions, because two good bosses are better than one.

Having your children under the age of 40 also has several benefits, as it helps you grow with your children and helps carry the financial burden of raising your children while you are still young.

8. Build a solid base of passive income streams from paper assets. Paper assets are one of the greatest ways rich people make money almost effortlessly! Warren Buffett is one of the richest men on earth because of his paper assets. Imagine you have invested N50 000 000 in a mutual fund with a low annual interest rate of 10%. This means that it would earn approximately N5,000,000 annually and N 4,16,666 monthly. If you continue to invest interest and capital, you will increase even more in the coming years. Therefore, the rich are getting richer because they use the power compound to use the paper resources.

Before the age of 40, this is the best time to buy a lot of paper assets. Invest in stocks, treasury bills, bonds, mutual funds and other paper assets. He is interested in a wide range of paper resources.

9. Investing in real estate: Investing in real estate is one of the best investments you can ever make because it is always appreciated in value over time. In addition to food, rental housing costs are one of the biggest expenses for the family.

Before you turn 40, it would be good to build your house. See here how you can build your low-income home. In the worst case, even if you haven’t built a house, try to buy land before you’re 40 years old.

10. You have your own farm: Have you thought about how people without farmers would survive? You can say, ‘I don’t have to be a farmer, because I can always buy the food I need’. Let me ask you: What if you have money to buy food and there is no food to buy because there are no farmers?

Even if you don’t want to grow full time, try a backyard garden where they plant vegetables. This will help you appreciate the wonderful work that farmers do.

Investing in agriculture can also be a good way to build wealth. There is always a market available for agricultural products. I have written several articles on agro-industry and how you can benefit from it.

11. Start giving to others: You can get as much wealth and wealth as you can, but if you can’t find a way to help others, you won’t know what the accomplishment is. The true measure of life does not lie in how much you have, but in how much you give.

Start allocating a portion of your monthly income to help others, especially the needy, children, and the elderly. You can take responsibility for sponsoring a disadvantaged child through school. You can adopt a child. You can meet the needs of disadvantaged children and the elderly on a monthly basis.

I can really do this without the stress of writing articles and maintaining this blog as I don’t get a reasonable financial benefit from it. My joy, though, is that this blog is helping thousands of people overcome poverty and remain financially stable.

Start handing out people now. You don’t have to be very rich to help others. Give what little you have because it opens more doors of resources. There are many people around you who need your help and help. You can deliver cash or to babies in need, disabled and motherless at home. You can sponsor a poor child through school. There are inexhaustible ways to give to others.

Bonus Tips:

1. Write a will. Many financial experts recommend getting a lawyer to help you make a will that legally grants ownership of your properties to everyone you want when you go ahead. This is especially important in conflicting families.

2. Buy an insurance policy: Several financial experts also advise you to buy life insurance. The goal is to give your loved ones a financial advantage if you go further.

There you have it. It is not good for anyone to collect information unless it is used. The choice is yours.

For more suggestions, leave a comment in the section below.

Don't forget to like, share and follow me for more updates. All these things come naturally to someone as he ages. These things are not taught. |

| Re: 11 Financial Steps You Should Take Before Age 40 by Halo22: 2:56pm On Sep 11, 2021 |

God bless you Mr or Mrs Op as u have wonderfully made my day. In fact as a guy that is about to marry, I am equally thinking on how to stabilize my flow of income before heading towards 40. But with this write-up, I have attained about 60% of the answers to my enquiry. Once again, remain blessed for not being economical with ideas. 1 Like |