CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults - Politics - Nairaland

Nairaland Forum / Nairaland / General / Politics / CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults (1587 Views)

Nobody Allowed To Build Bank Vaults At Home – Emefiele / Lekki Port Ready For Delivery As It Reaches 80 Percent Completion / Abati Declares Buhari Cabinet Worst Since 1999, Why 80 Percent Should Be Fired (2) (3) (4)

| CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 2:06pm On Oct 29, 2022 |

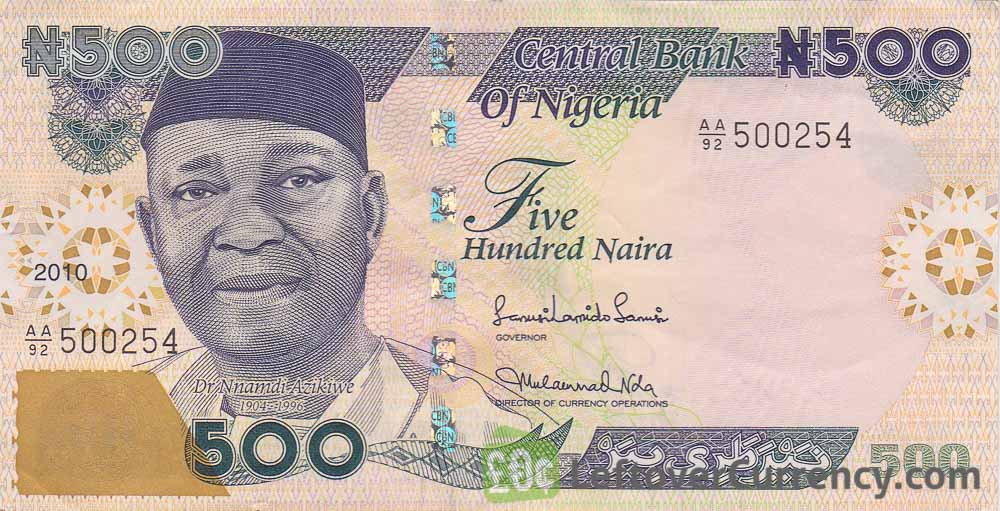

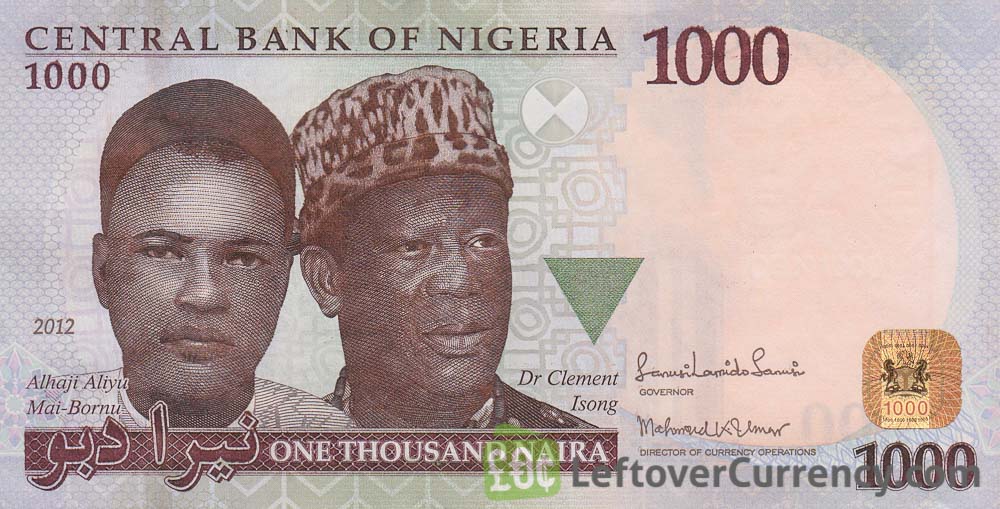

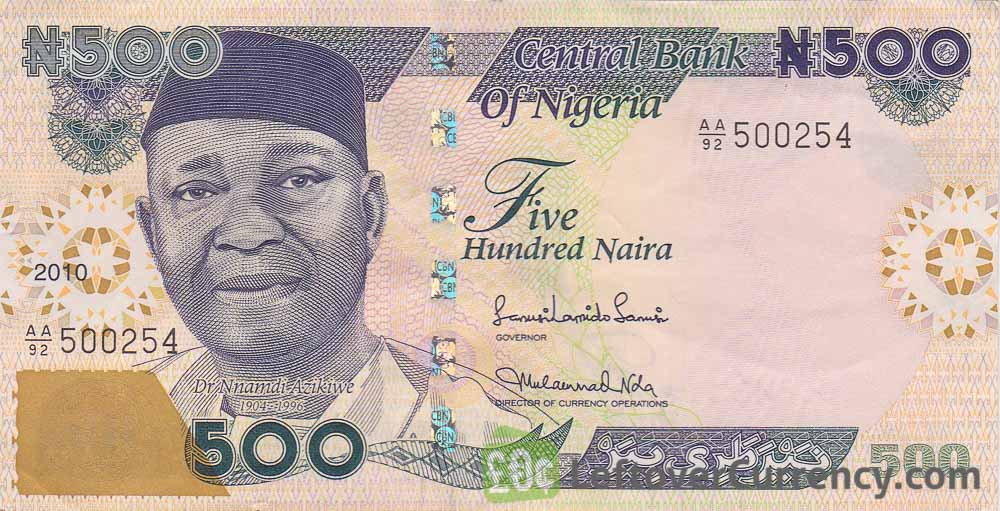

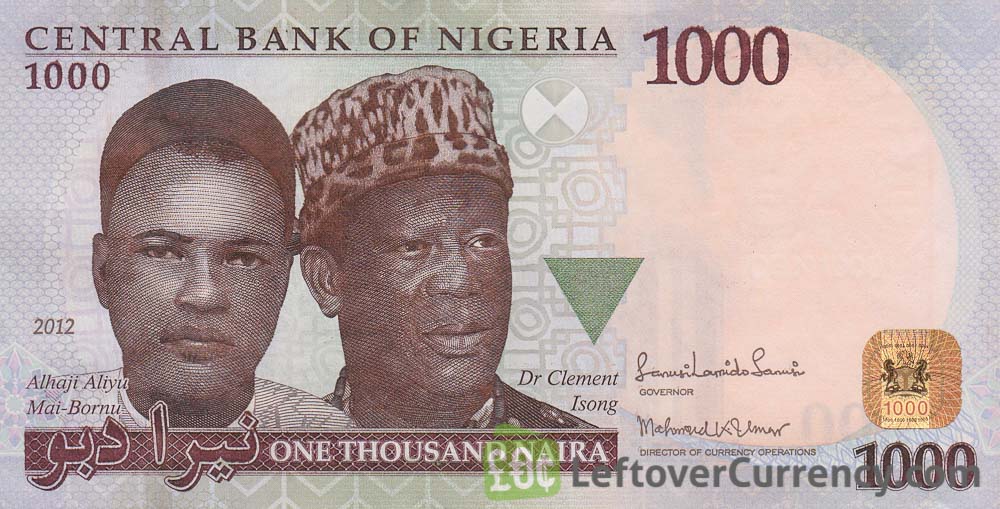

CBN: Here Is Why 80 percent of the nation’s currency notes outside bank vaults Preponderance of POS Business. Here is why: Each POS business operator, hold an average #200,000 in their purse daily to ensure they satisfy their customers who may want to withdraw money through their business. Let's do the calculation. Some street can have about 10 POS business operators. If each of the operator has #200k in their purse, that will make about two Million Naira. Just for one street. According to https://www.statista.com/statistics/1178109/number-of-pos-terminals-in-nigeria/ , there about 1.1million POS in operation as of june 2022. Now 1100,000 multiplied by #200,000 will give 220,000,000,000. There may be other contributing factors but I think this is a major one. Also: I also believe that CBN Should Also Phase Out #1000 and #500 Notes And reintroduce Nigeria coins, 50Kobo, 1 NGN and 2 NGN. CBN Should Phase Out #1000 and #500 Notes And reintroduce Nigeria coins, 50Kobo, 1 NGN and 2 NGN.  CBN Should Phase Out #1000 and #500 Notes And reintroduce Nigeria coins, 50Kobo, 1 NGN and 2 NGN. Nigeria will not be the first nation to discontinue with bank notes with high face values. The United State of America USA used to have $500, $1000, $2000 currency notes until December 14, 1945, when the high denominational bills were last printed and officially discontinued on July 14, 1969 by the Federal Reserve System. European Central Bank also phased out the printing and use of use of 500 Euro notes in 27 April 2019. Top performing currency in the world make use of coins and the maximum face value for their bank notes is 200. Here is a list of top performing currencies, their bank note value values and their coins: --.Kuwait Dinar KWD: ( 1 KWD = 1,412.78 NGN ) Bank notes: 1/4, 1/2, 1, 5, 10, 20 Dinars Coins: 5, 10, 20, 50, 100, 200 Fils --.Bahraini Dinar BHD: ( 1 BHD = 1,159.41 NGN ) Bank note: BD 1/2, BD 1, BD 5, BD 10, BD 20 Coins: 5, 10, 25, 50, 100 Fils, BD 1/2 --.Omani Rial OMR: ( 1 OMR = 1,135.00 NGN ) Bank note: 1/2, 1, 5, 10, 20, 50 Rials Coin: 50, 10, 20, 50, 100 baisa and rarely used 200 biasa --.Jordanian Dinar JDD: ( 1 JDD = 616.44 NGN ) Bank notes: 1, 5, 10, 20, 50, Dinars Coins: 1/2, 1, quirsh, 21/2, 5, 10 Piastras --.British Pound GBP: ( 1 GBP = 507.29 NGN ) Bank notes: €5, €10, €20, €50 Coins: 1P, 2P, 5P, 10P, 50P, €1, €2 --.Caymanian Dollar KYD: ( 1 KYD = 525.03 NGN ) Bank notes: 1, 5, 10, 25, 50, 100 Dollars Coin: 1, 5, 10, 25 Cents --.Euro EUR: ( 1 EUR = 439.65 NGN ) Bank notes: €5, €10, €20, €50, €100, €200 and €500 --.Swiss Franc CHF: ( 1 CHF = 442.99 NGN ) Bank note: 10, 20, 50, 100, 200, 1000 francs Coins: 5, 10 and 20 Rp/cts, 1/2, 1, 2 and 5 Fracs --.United State Dollar USD: ( 1 USD = 437.05 NGN ) Bank note: $1, $2, $5, $10, $20, $50, $100 Coins: 1C, 5C, 10C, $1/4, $1/2, $1. To stabilize Naira and reduce inflation, I believe that there are many economics to be considered but I strongly believe that my suggestion is one of major factor to put into place.   1 Like 1 Share |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by youngbabaj(m): 2:06pm On Oct 29, 2022 |

Mtcheeeeew 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 2:08pm On Oct 29, 2022 |

CBN Should Phase Out #1000 and #500 Notes And reintroduce Nigeria coins, 50Kobo, 1 NGN and 2 NGN.  CBN Should Phase Out #1000 and #500 Notes And reintroduce Nigeria coins, 50Kobo, 1 NGN and 2 NGN. Nigeria will not be the first nation to discontinue with bank notes with high face values. The United State of America USA used to have $500, $1000, $2000 currency notes until December 14, 1945, when the high denominational bills were last printed and officially discontinued on July 14, 1969 by the Federal Reserve System. European Central Bank also phased out the printing and use of use of 500 Euro notes in 27 April 2019. Top performing currency in the world make use of coins and the maximum face value for their bank notes is 200. Here is a list of top performing currencies, their bank note value values and their coins: --.Kuwait Dinar KWD: ( 1 KWD = 1,412.78 NGN ) Bank notes: 1/4, 1/2, 1, 5, 10, 20 Dinars Coins: 5, 10, 20, 50, 100, 200 Fils --.Bahraini Dinar BHD: ( 1 BHD = 1,159.41 NGN ) Bank note: BD 1/2, BD 1, BD 5, BD 10, BD 20 Coins: 5, 10, 25, 50, 100 Fils, BD 1/2 --.Omani Rial OMR: ( 1 OMR = 1,135.00 NGN ) Bank note: 1/2, 1, 5, 10, 20, 50 Rials Coin: 50, 10, 20, 50, 100 baisa and rarely used 200 biasa --.Jordanian Dinar JDD: ( 1 JDD = 616.44 NGN ) Bank notes: 1, 5, 10, 20, 50, Dinars Coins: 1/2, 1, quirsh, 21/2, 5, 10 Piastras --.British Pound GBP: ( 1 GBP = 507.29 NGN ) Bank notes: €5, €10, €20, €50 Coins: 1P, 2P, 5P, 10P, 50P, €1, €2 --.Caymanian Dollar KYD: ( 1 KYD = 525.03 NGN ) Bank notes: 1, 5, 10, 25, 50, 100 Dollars Coin: 1, 5, 10, 25 Cents --.Euro EUR: ( 1 EUR = 439.65 NGN ) Bank notes: €5, €10, €20, €50, €100, €200 and €500 --.Swiss Franc CHF: ( 1 CHF = 442.99 NGN ) Bank note: 10, 20, 50, 100, 200, 1000 francs Coins: 5, 10 and 20 Rp/cts, 1/2, 1, 2 and 5 Fracs --.United State Dollar USD: ( 1 USD = 437.05 NGN ) Bank note: $1, $2, $5, $10, $20, $50, $100 Coins: 1C, 5C, 10C, $1/4, $1/2, $1. To stabilize Naira and reduce inflation, I believe that there are many economics to be considered but I strongly believe that my suggestion is one of major factor to put into place.  1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 2:30pm On Oct 29, 2022 |

I will be glad if our mod consider this thread frontpage worthy. This will help to collect people's input about the topic. 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 1:26pm On Oct 30, 2022 |

Some simple stuffs as these doesn't need to be complicated |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by GodHatesJews: 1:32pm On Oct 30, 2022 |

The entire point of a paper currency is to have it in circulation and not idling in vaults. Paper currency as the word currency implies, is meant to circulate and is an instrument of debt owed an individual. Paper currencies were designed to prevent carrying of real cash in the form of gold. A paper receipt indicating the amount or volume of gold owed someone by a bank , govt or a third party is what paper currency signifies. On it's own, it is worthless and just a note redeemable at the treasury or vault. To now make paper currency appear more valuable when in the case of the naira is backed by an equally worthless paper currency in the form of the USD is by far the longest and greatest scam ever perpetuated on humanity and on such a grand scale and period. Humans are stupid . |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Charisma01: 1:52pm On Oct 30, 2022 |

God bless you for this thread. The suggestion that the 200 and 500 should be discontinued is the best idea. These notes contributed a lot to inflation in the land. 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Munamoqel: 1:55pm On Oct 30, 2022 |

UncleAyo:there are about 200,000 pos holding 200000 k each =400bn less than 15 percent of the .3.7 trillion |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 2:12pm On Oct 30, 2022 |

Munamoqel: 1. I will not deny, there might be other factors responsible for hoarding of cash 2. I believe there will be much more than 200,000 POS operators in Nigeria because each of the 36 states (plus the FCT) has more than 5,405 POS Operators in the individual states. 200,000 ÷ 37(states) = 5405. 3. CBN cannot be trusted with their figures... although the real amount of the hoarded cash may be closer. |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by GodHatesJews: 2:12pm On Oct 30, 2022 |

Charisma01: You are an idiot. The money supply will continue to grow as long as both unchecked govt borrowing, spending and reckless money minting goes on in the CBN. Denominations have nothing to do with the entire debt in circulation. It only contributes to volume in notes and not its entire value. So if given 100,000 naira in 100 naira notes or 100,000 in 1,000 naira notes, its value osmt based on volume but its purchasing power. Do not confuse volume of currency to actual value . You people are hopelessly illiterate on this forum. 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Munamoqel: 2:23pm On Oct 30, 2022 |

UncleAyo:you don't trust the CBN and you don't have the data . Confused. 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 2:37pm On Oct 30, 2022 |

Munamoqel: Help us here with data if you have any. We will be glad you did. As of now, I still believe the amount is a suggested estimation, but if you have found any data online, please, share with us. Thanks. |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Munamoqel: 2:52pm On Oct 30, 2022 |

UncleAyo:Nigeria Interbank Settlement (NIBSS) data showed there are about 307,000 Point of Sale (Pos) machines in Nigeria, 30,000 Automated Teller Machines, and over 6,000 bank branches. However, majority of the PoS machines, which are fast being accepted by cardholders are not active. Only 167,000 of the PoS are active and majority malfunction at the point of trial. Many merchants have continued to collect legal fees from cardholders who want to use their cards |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Charisma01: 4:20pm On Oct 30, 2022 |

GodHatesJews: What did you smoke this afternoon? Did i say it increased the debt in circulation? When these notes were introduced, they caused the coins and lower denomination notes as 50 kobo, 1 Naira and 5 naira to disappear 1 Like |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by excanny: 5:10pm On Oct 30, 2022 |

As long as we run a cash based economy, 80% of cash printed will always be outside the banks no matter how many times you change the currency. |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 6:03pm On Oct 30, 2022 |

Charisma01: I noticed the miscontrue too |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by porka: 6:22pm On Oct 30, 2022 |

This is not what is meant by money outside the banking system. POS is in the financial system. A POS operator is a mini branch of a bank. Each of the withdrawal is from an account. They dispense cash to bank account holders. You should see POS operators as banks' ATM machine. You cannot get money from the POS operator except you have money in your bank account. They have to fund their accounts before they withdraw cash again, which means the money is still in the banks. Money outside the financial system are the ones that do not go through any account. They come from the POS, ATM, bank teller and never find their way back through any other transaction. 2 Likes |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by kenny714433(m): 7:23pm On Oct 30, 2022 |

The OP doesn't know anything. God bless the commenter above me. Money in POS is part of the circulating currency. Within a month, those money will find its way back into the bank and out of the bank. We have Total Supply and Circulating Supply these supplies are supposed to balance each other but they are not. In order to create the balance, CBN wants to introduce the cryptocurrency term which is known as Burning. With burning, circulating supply will increase and there will be more value to the naira as excess notes will be taken off. Remember, the lesser the supply, the more valuable the coin. 2 Likes |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 8:45pm On Oct 31, 2022 |

According to https://www.statista.com/statistics/1178109/number-of-pos-terminals-in-nigeria/, there about 1.1million POS in operation as of june 2022. Now 1100,000 multiplied by #200,000 will give 220,000,000,000. There may be other contributing factors but I think this is a major one. |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by Nobody: 9:07pm On Oct 31, 2022 |

kenny714433: there is nothing like a total supply of money- the supply of money itself is infinite. that is because banks can create money burning has been in existence before the crypto concept of burning, burning fiat is all about burning old currencies An increase in the supply of money typically lowers interest rates, which in turn, generates more investment and puts more money in the hands of consumers, thereby stimulating spending. a decrease in money supply slows down the economy |

| Re: CBN: Here Is Why 80 Percent Of The Nation’s Currency Notes Outside Bank Vaults by UncleAyo: 9:20am On Nov 02, 2022 |

everybody has an opinion |

(1) (Reply)

My Grandfather Left My Dad Millions And My Dad Left Me 500k. What Should I Do? / Breaking: Stop Supporting Tinubu So That God Won't Punish You & Take Your Life / 2023: Ten Reasons Tinubu Can't Win - OfficialAPCNig

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 69 |